Can We Claim Itc On Repairs And Maintenance Of Computer . Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. Web you can generally claim itcs only for the part of the gst/hst paid or payable for the property or service that. Section 16 of cgst i.e. Web 21st december 2021. So, the taxpayers can no longer. Eligibility and conditions for taking input tax credit. Web generally, if you have an eligible expense that you intend to use only in your commercial activities, you can. Web 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit.

from gotechsite.com

Web you can generally claim itcs only for the part of the gst/hst paid or payable for the property or service that. Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. Web generally, if you have an eligible expense that you intend to use only in your commercial activities, you can. So, the taxpayers can no longer. Web 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. Eligibility and conditions for taking input tax credit. Section 16 of cgst i.e. Web 21st december 2021.

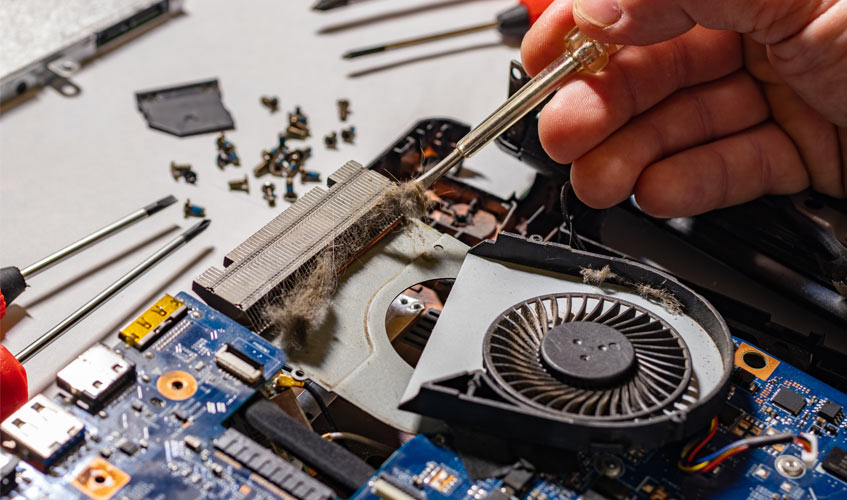

The Essential Guide to PC Maintenance Support

Can We Claim Itc On Repairs And Maintenance Of Computer Eligibility and conditions for taking input tax credit. Web 21st december 2021. Eligibility and conditions for taking input tax credit. Web generally, if you have an eligible expense that you intend to use only in your commercial activities, you can. Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. Web 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. So, the taxpayers can no longer. Section 16 of cgst i.e. Web you can generally claim itcs only for the part of the gst/hst paid or payable for the property or service that.

From mitchellpcrepairs.com.au

Mitchell PC Repairs 02 6262 3000 Computer Repairs Canberra Can We Claim Itc On Repairs And Maintenance Of Computer Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. So, the taxpayers can no longer. Section 16 of cgst i.e. Web generally, if you have an eligible expense that you intend to use only in your commercial activities, you can. Eligibility and conditions for taking. Can We Claim Itc On Repairs And Maintenance Of Computer.

From thelabrepair.com

DIY Computer Repair Risks The Lab Warsaw, Indiana Can We Claim Itc On Repairs And Maintenance Of Computer Web you can generally claim itcs only for the part of the gst/hst paid or payable for the property or service that. Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. Eligibility and conditions for taking input tax credit. Web 21st december 2021. So, the. Can We Claim Itc On Repairs And Maintenance Of Computer.

From www.youtube.com

HOW TO CLAIM ITC ITC REVERSAL & ITC CLAIM ENTRY IN TALLY ERP9 Can We Claim Itc On Repairs And Maintenance Of Computer Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. Eligibility and conditions for taking input tax credit. Section 16 of cgst i.e. Web 21st december 2021. So, the taxpayers can no longer. Web generally, if you have an eligible expense that you intend to use. Can We Claim Itc On Repairs And Maintenance Of Computer.

From cleartax.in

ITC02A Form under GST Applicability and Procedure to file on GST Portal Can We Claim Itc On Repairs And Maintenance Of Computer Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. Web generally, if you have an eligible expense that you intend to use only in your commercial activities, you can. Web 22 rows have a look on goods and services that are not eligible to claim. Can We Claim Itc On Repairs And Maintenance Of Computer.

From www.taxscan.in

GSTN enables Changes in table 4 of GSTR3B related to the claim of ITC Can We Claim Itc On Repairs And Maintenance Of Computer Section 16 of cgst i.e. Web 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. Web generally, if you have an eligible expense that you intend. Can We Claim Itc On Repairs And Maintenance Of Computer.

From garagefixpreavisesul.z22.web.core.windows.net

Game Systems Repair Can We Claim Itc On Repairs And Maintenance Of Computer So, the taxpayers can no longer. Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. Eligibility and conditions for taking input tax credit. Web you can generally claim itcs only for the part of the gst/hst paid or payable for the property or service that.. Can We Claim Itc On Repairs And Maintenance Of Computer.

From www.dreamstime.com

Computer Repair Service stock image. Image of protection 19568581 Can We Claim Itc On Repairs And Maintenance Of Computer Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. Section 16 of cgst i.e. So, the taxpayers can no longer. Web 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. Eligibility and conditions for taking. Can We Claim Itc On Repairs And Maintenance Of Computer.

From www.youtube.com

Can Cooperative Hsg Society claim ITC on Works Contract Services Can We Claim Itc On Repairs And Maintenance Of Computer Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. Web you can generally claim itcs only for the part of the gst/hst paid or payable for the property or service that. Section 16 of cgst i.e. Web generally, if you have an eligible expense that. Can We Claim Itc On Repairs And Maintenance Of Computer.

From cleartax.in

ITC 01 Step by Step Guide to File a form to claim ITC for New GST Can We Claim Itc On Repairs And Maintenance Of Computer Web 21st december 2021. Web you can generally claim itcs only for the part of the gst/hst paid or payable for the property or service that. Web generally, if you have an eligible expense that you intend to use only in your commercial activities, you can. Section 16 of cgst i.e. Eligibility and conditions for taking input tax credit. Web. Can We Claim Itc On Repairs And Maintenance Of Computer.

From gotechsite.com

The Essential Guide to PC Maintenance Support Can We Claim Itc On Repairs And Maintenance Of Computer Web generally, if you have an eligible expense that you intend to use only in your commercial activities, you can. Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. Web 21st december 2021. Web you can generally claim itcs only for the part of the. Can We Claim Itc On Repairs And Maintenance Of Computer.

From www.youtube.com

ITC AwarenessInput on purchaseclaim ITCWhat is input credithow to Can We Claim Itc On Repairs And Maintenance Of Computer Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. So, the taxpayers can no longer. Web 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. Web you can generally claim itcs only for the part. Can We Claim Itc On Repairs And Maintenance Of Computer.

From www.postermywall.com

Copy of Computer Repair & Services Flyer Template PosterMyWall Can We Claim Itc On Repairs And Maintenance Of Computer Web 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. Web 21st december 2021. Eligibility and conditions for taking input tax credit. Web generally, if you have an eligible expense that you intend to use only in your commercial activities, you can. Web you can generally claim itcs only for. Can We Claim Itc On Repairs And Maintenance Of Computer.

From www.rit-uk.co.uk

Computer Repairs Revitalized IT Computer Repairs, Mobile Phone Can We Claim Itc On Repairs And Maintenance Of Computer So, the taxpayers can no longer. Section 16 of cgst i.e. Web 21st december 2021. Eligibility and conditions for taking input tax credit. Web generally, if you have an eligible expense that you intend to use only in your commercial activities, you can. Web 22 rows have a look on goods and services that are not eligible to claim (itc). Can We Claim Itc On Repairs And Maintenance Of Computer.

From www.ginesys.in

Maximize Your ITC Claim Here are 4 things you need to do! Can We Claim Itc On Repairs And Maintenance Of Computer Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. So, the taxpayers can no longer. Web 22 rows have a look on goods and services that are not eligible to claim (itc) input tax credit. Web generally, if you have an eligible expense that you. Can We Claim Itc On Repairs And Maintenance Of Computer.

From www.imcgrupo.com

Why is Computer Maintenance So Important? IMC Grupo Can We Claim Itc On Repairs And Maintenance Of Computer Section 16 of cgst i.e. Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. Web 21st december 2021. Web generally, if you have an eligible expense that you intend to use only in your commercial activities, you can. Web you can generally claim itcs only. Can We Claim Itc On Repairs And Maintenance Of Computer.

From cleartax.in

ITC02 for Transfer of ITC in case of Merger Format, Contents, and Can We Claim Itc On Repairs And Maintenance Of Computer Section 16 of cgst i.e. So, the taxpayers can no longer. Web generally, if you have an eligible expense that you intend to use only in your commercial activities, you can. Web 21st december 2021. Eligibility and conditions for taking input tax credit. Web the allowability of itc of gst paid on building repairs is a matter of confusion among. Can We Claim Itc On Repairs And Maintenance Of Computer.

From rebootthat.com

Desktop PC repair in London We collect and fix all makes of computer Can We Claim Itc On Repairs And Maintenance Of Computer Web the allowability of itc of gst paid on building repairs is a matter of confusion among the various professionals and prone to litigation. Eligibility and conditions for taking input tax credit. Web 21st december 2021. So, the taxpayers can no longer. Web generally, if you have an eligible expense that you intend to use only in your commercial activities,. Can We Claim Itc On Repairs And Maintenance Of Computer.

From www.megatronicstech.com

5 Essential Routine Computer Maintenance Tasks Business Computer Can We Claim Itc On Repairs And Maintenance Of Computer So, the taxpayers can no longer. Section 16 of cgst i.e. Web you can generally claim itcs only for the part of the gst/hst paid or payable for the property or service that. Web generally, if you have an eligible expense that you intend to use only in your commercial activities, you can. Web 22 rows have a look on. Can We Claim Itc On Repairs And Maintenance Of Computer.